After being a Financial Planner for over 30 year and being an avid investor for over 45 years. I thought I’d seen it all.

Maybe I was wrong? Australians rushing out buying toilet paper and fighting over it like it was gold being handed out for free.

Some wise person once said:

“Off with the head and on goes a pumpkin!”

Thank god my clients still have their own head and use the knowledge they have gained through us and are not making irrational decisions about their investments.

Yes, the phone rang, and yes, we are all concerned, but the vast majority asked me then same question.

Q: “Bill, in all your correspondence you have sent us this calendar year - is this what you meant when you said, “This is how the rich get richer and the poor get poorer”?

A: YES!

Then most asked me…

Q: “Is the time right now to start to invest when assets values have fallen greatly?”

A: YES! (but I also say) patience grasshopper.

This crisis will eventually pass, as investors and Australians become accustomed to the new normal that included the new coronavirus COVID-19, becoming a normal part of daily life along with the flu, obesity, car accidents and other medical issues.

The difficult part is the ‘unknown’ as we don’t know how long the dislocation phase will last, where we need to reduce social interaction and possible isolation for a limited time. This has significant economic impacts and greatly increases the probability of a recession.

The global markets have moved from raging Bull to Bear Market. How long will this last and when is it good to start investing again?

That’s the Million-dollar question.

The answer is; nobody knows. The best advice is everybody’s situation is vastly different and you need individual high-quality advice.

What I do know is;

- That we are in a bear market and we don’t know how far away the bottom is.

- That right now there is possibly some phenomenal buying opportunities.

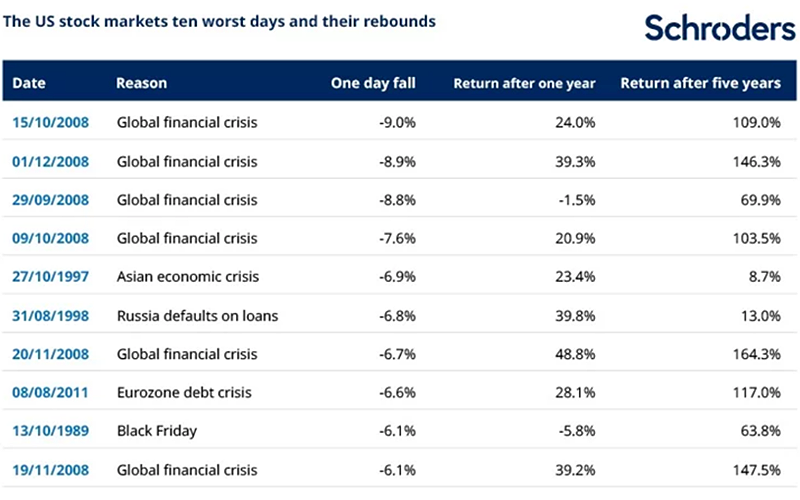

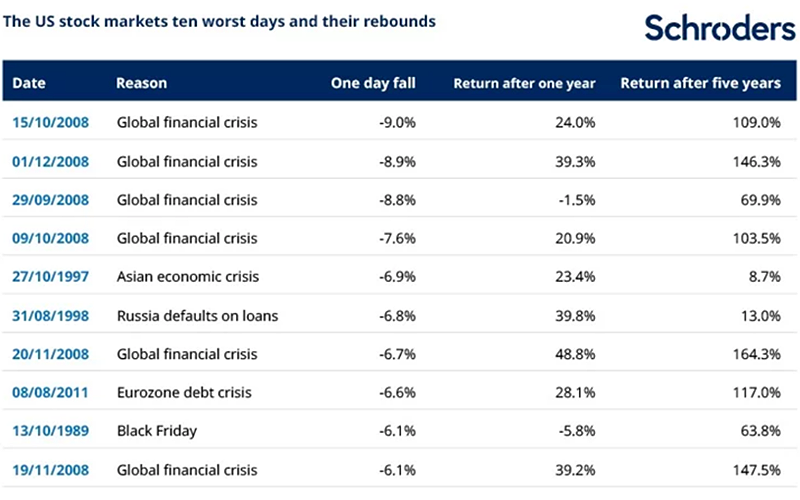

- That markets perform over time and bounce back as seen in the below table.

Source: Schroders. Refinitv data correct as at 3 March, 2020. Data shown is for the S&P 500 Total Return Index, which includes price increases and dividend payments. Past performance is not a guide to future returns. 413199

- This is a period of adjustment because we are moving from a long Bull market and nobody can ever pick the bottom of the Bear Market (nor the top of the Bull Market for that matter).

- If you buy somewhere towards the bottom of the market, there is exceptional value and money to be made.

- In times like this, the poor unadvised panic and sell at the bottom, and the well-advised rich buy from the poor. That’s how the Rich get Richer!

- I’ve started investing part of my spare cash back into to the market.

- I’ve been through many of these volatile times before I’ve learnt what to do and how to best advise clients, as do all our Financial Planners at Sydney Financial Planning.

If you still have questions and things are not clear; I urge you to arrange to talk with your Financial Planner.

Bill Bracey and the advice team

Have you set things up to weather this trend?

If you need your personal situation reviewed by your Financial Planner or you don't have a planner yet, get in contact with us on 02 9328 0876.

Bill Bracey – Principal & Senior Financial Planner | Sydney Financial Planning

General Disclaimer: This article contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information. Please seek personal financial advice prior to acting on this information.